CLV Modeling To Boost Customer Retention Rates: In this ultra-competitive market, entrepreneurs like you should always look for ways to stop your customers from walking away. To boost customer retention rates, you can utilize customer lifetime value or CLV modeling.

Table of Contents

For some entrepreneurs, it’s a concept that’s overlooked. But what if we told you that its impact can be immensely helpful in growing your business?

With this article, you’ll explore how to use the customer lifetime value formula to determine the value of your existing customers and how to leverage this information to increase repeat business and purchase frequency.

On top of that, we’ll provide practical examples of how to use CLV to optimize customer retention and increase lifetime value. Plus, we’ll discuss how you can integrate it into your marketing strategy and sales forecasting process. In the end, you’ll have a better grasp of what CLV can do to boost your business as well as master ways on how to retain your audience.

So, let’s start.

What Is CLV Modeling & Why Is It Important For Businesses?

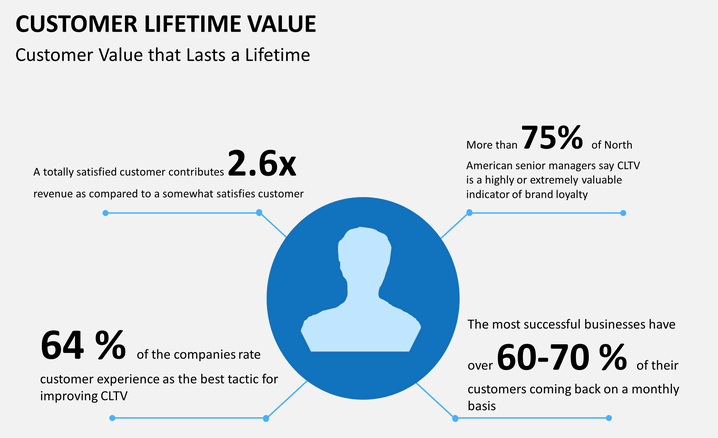

Customer lifetime value modeling is a powerful tool that allows businesses to calculate the total monetary value of their customer relationships over time. It’s a metric that lets you understand the long-term worth of each customer, based on their purchasing behavior.

In addition, calculating the CLV allows you to identify your best customers and analyze their purchasing patterns. You can then leverage the information and understand how customers interact with your product or service. Thus, you can make informed decisions about marketing, pricing, and retention strategies.

But who are those best customers? Well, they’re also known as your high-value customers. They are the ones who generate the most revenue and yield the greatest profit margins for your company.

By understanding their behavior and preferences, you can tailor your retention and marketing strategies to continuously meet their needs. Plus, this can help you strengthen customer loyalty.

What’s more, CLV will help you analyze the lifetime value of your average number of customers. As such, you can assess the revenue you anticipate from an average customer throughout their entire association with the company.

Having this information, you can make informed decisions on how to distribute resources effectively for advertising, customer retention, and other endeavors that will enhance the average CLV of your market.

Those are just a sliver of the CLV model’s benefits. We’ll discuss more throughout his article. For now, let’s discuss the customer lifetime value formula and its components so you’ll have an idea of how to apply it to your company.

Customer Lifetime Value: The Formula & Its Components

As mentioned, the CLV equation allows you to compute the overall sum of money that a customer will spend during their lifetime association with a business.

Here’s the formula to measure customer lifetime value:

CLV = Average Order Value x Purchase Frequency x Average Customer Lifespan

We’ll break it down to give you a clear idea of how to calculate customer lifetime value for your business.

Step 1: Average Purchase Value (APV)

To calculate this, you need to divide the total revenue generated by a customer by the number of purchases they made during the period you’re analyzing. For example, if a customer made 20 purchases in a year and generated $2,000 in revenue, their APV will be $100. The image below shows you how to do it.

This is relatively straightforward. However, ensure you’re using accurate data. Hence, you’ll need to have robust data tracking systems in place to have a comprehensive overview of all the purchases a customer has made within your chosen time frame.

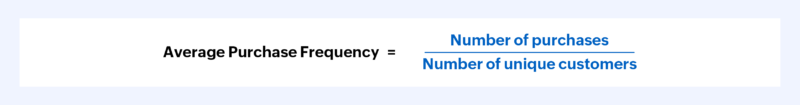

Step 2: Average Purchase Frequency (APF)

To calculate this, you need to divide the total number of purchases made by all unique customers by the total number of unique customers. Take a look at the image below to see how the formula looks.

For instance, let’s say your company generated $30,000 in revenue over a year from a group of 50 unique customers who made a total of 250 purchases. Using the formula, the APF is 5, indicating that each customer made an average of 5 purchases during the year.

This is important for the customer lifetime value calculation because it lets you estimate the potential number of purchases a customer may make in the future. Thus, enabling you to make more accurate projections of future revenue.

However, the APF may vary for new customers compared to repeat customers. New buyers often make fewer purchases initially as they familiarize themselves with the product or service.

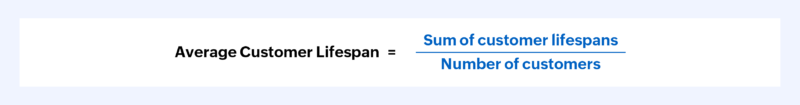

Step 3: Average Customer Lifespan (ACL)

To calculate this, you need to divide the sum of customer lifespans by the number of customers you have. The image below shows what the formula looks like.

In case you’re wondering, a customer lifespan is the total amount of time a customer interacts with a business. It measures the duration of the customer-business relationship and is crucial to determining the total profitability of a company.

However, what if you’re just a startup with no customer sample size for this equation? Well, this is when the churn rate comes to light.

The churn rate measures the percentage of consumers who stopped using a product or service over a given period. It will help you understand how well you’re retaining customers and identify areas for improvement. Although in this instance, it’s used to calculate the ACL.

This is the formula: Churn rate = (Number of customers lost during a period / Total number of customers at the beginning of the period) x 100

For example, if you had 400 customers at the beginning of a month and lost 50 of them during that month, the churn rate will be:

Customer churn rate = (50 / 400) x 100 = 12.5%

This means that 12.5% of the customers stopped buying from you or ceased to use your service during that month. So, this is how the ACL formula will look like:

ACL = 1 / churn rate

With our sample values, it will look like: ACL = 1 / 12.5% or 0.125

The answer is 8 months. That is the sum of customer lifespans you will put in the original equation for ACL, which is shown in the photo above.

Following that, it’s time to discuss CLV’s impact on boosting the retention rate of your business.

How Does Customer Lifetime Value Improve Retention Rates?

Implementing customer lifetime value calculations can help a business like yours understand the existing customers and identify customer segments to target for increased retention rates.

Therefore, you can make more income and reduce customer acquisition costs by raising retention rates. So, let’s see how you can do it.

1. Identify Your High-Value Customers And Build Relationships With Them

By leveraging your customer lifetime value calculations, you can identify and forge better relationships with your high-value target customers.

Here are a few things you can do:

- Analyze the average lifetime value of each existing customer: You can use past data to determine how much revenue your active customers generate over their lifetime with your business.

- Provide personalized experiences: Use the data you’ve collected to provide tailored experiences that cater to their demand. This entails providing exclusive offers (e.g. a discount rate) or individualized suggestions.

Moreover, by nurturing your customer relationships, your high-value buyers will be encouraged to continue doing business with you. Thus, they’ll spend more on your products and services, provide valuable feedback, and help spread the word about your brand.

In essence, when you keep meeting their needs as well as providing excellent customer service and communication, you foster customer loyalty.

2. Identify Pain Points

Customer lifetime value (CLV) modeling can be used to identify customer pain points by analyzing customer behavior and purchase history. After all, you need to do it anyway when you calculate the CLV for your business.

When you analyze your customers’ interactions with your business, you can identify areas where they may be experiencing difficulties or pain points in their buyer journey. Thus, the insights you get can be used to develop strategies to address the issues and improve the overall customer experience.

So, how do you determine the pain points? Well, there are several ways.

You can review customer feedback. This can include the ones posted on social media channels, online review forums, or customer surveys you send out. When you review what’s said about you by customers on different platforms, it can give you an overview of their possible complaints.

Additionally, you can analyze customer behavior patterns. For example, let’s say a few of your customers abandon their shopping carts or return items frequently. It will suggest a problematic area or pain point in the buying process or product quality. Or maybe you need to improve your onboarding process.

You can develop strategies to address these pain points and improve the overall customer experience. This can include providing additional support or resources to customers, streamlining the purchase process, or improving product quality. Plus, this will be great for each existing customer, and not just the ones who experienced problems.

When you focus on resolving issues and being better, you can improve customer retention rates, customer satisfaction levels, and customer loyalty.

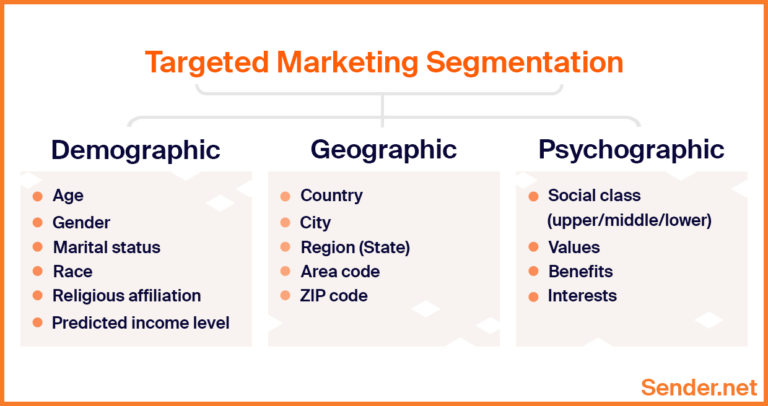

3. Improve Targeted Marketing Efforts

Another way to increase the retention rate through the CLV model is by creating targeted marketing campaigns for specific customer segments. This will allow you to customize your marketing efforts to meet the unique needs and preferences of different groups of customers. Hence, increasing the likelihood of repeat business and higher customer lifetime value.

Of course, the way you communicate with another customer segment will be different. Not all of them are created equal in terms of their value to the business. By segmenting customers and measuring their lifetime value, you can identify which groups are the most valuable and focus your efforts on retaining those customers.

For instance, once you identify your high-value buyers, you can create a targeted marketing campaign to keep them engaged with the brand. Tailoring the messaging and special offers to this group can increase their loyalty and encourage them to spend more, leading to a higher monetary value and profit margin.

Also, by focusing your marketing campaign on attracting high-value targets, you can increase the average revenue per customer and net profit. Overall, you’ll need to rely on customer segmentation to ensure the right marketing campaigns are targeted to the right people.

4. Enhance Sales Forecasting Process

Integrating customer lifetime value into the sales forecasting process allows you to boost retention rates because you can identify and prioritize your most loyal customers. Thus, you can focus your retention efforts on those who have the potential to generate the most revenue for the company.

Rather than focusing on a one-time customer who may not provide as much long-term revenue, you can focus your company’s resources and efforts to keep the already-loyal ones coming back. Thus, you can minimize the loss of resources to new customers who may not return after their first purchase.

When you use CLV to predict sales, you can estimate your future earnings more precisely by considering the anticipated value of repeat customers. You can adjust your sales strategies to better serve these customers and keep them engaged.

Overall, utilizing CLC with sales forecasting can help you understand the value of certain customer segments and the impact of retention efforts on your bottom line. By focusing on retaining loyal customers, you can generate more revenue and achieve greater profitability over time.

With that, we’ll discuss the different CLV models to guide you in understanding how to measure customer lifetime value.

3 Customer Lifetime Value Models

You know its formula and the great benefits it can bring to your business. But what about the techniques to get and analyze the data? Well, there are several CLV models to help you estimate the total value a customer will bring to your company throughout your relationship.

I. Predictive Model

This is used to forecast the future spending behavior of customers based on their past behavior and other relevant factors using a machine learning model. It uses historical data like demographics, purchase history, and engagement with the company to estimate the potential lifetime value of a customer.

For instance, let’s say a customer frequently purchases high-priced items from your brand, has been loyal over several years, and engages with your company through various channels, a predictive CLV model can estimate that the future value of this customer is high.

You can then use this information to tailor your customer relationship strategy accordingly, to maximize the customer’s lifetime value. For instance, DiLytics utilizes predictive analytics and artificial intelligence to help companies develop forecasts.

The data is then analyzed to help them make informed decisions, whether it’s to optimize their supply chain processes or have better financial insights. Not to mention, a prediction model can be tailored to the specific needs of your company and can help in forecasting the potential success of different business strategies.

II. Descriptive Model

The descriptive model for calculating customer lifetime value involves analyzing the transaction data of customers to identify patterns in their behavior. For example, by understanding the monetary value of the average customer and the likelihood of customer churn, you can identify opportunities to create more value and retain customers.

Another example is if a business earns significant revenue from a particular customer segment, the descriptive model can identify factors contributing to its high lifetime value. Thus, you can create targeted marketing campaigns, loyalty programs, or even a special discount rate to retain these valuable customers.

However, the descriptive model does require manual analysis and may not be scalable for businesses with large amounts of data.

III. Historical Model

As the name suggests, this uses historical data to predict the present value of a customer. It calculates CLV based on the average amount of money a customer has spent with a company in the past.

While this model can be useful for businesses that have customers who only interact with them over a certain period, it has some disadvantages. For example, the model does not take into account whether a customer will continue with the company or not.

As such, if you’re not careful, you’ll either be overestimating or underestimating their value. It also fails to capture changes in customer behavior, such as inactive customers who start buying again. This can lead to missed opportunities to increase customer value and revenue.

Despite its limitations, the historical model can be useful in measuring customer lifetime value and cash flow. Its model inputs are simple and easy to understand, making it a popular choice for businesses that are just starting to measure CLV.

Conclusion

Every business wants to retain customers, especially high-valued ones. However, it can be difficult to do so with so much competition in the market. Fortunately, CLV modeling can be applied to your business.

Will it be easy to do so? Well, that’ll depend on your business needs. This article has given you different CLV models, examples, and how they can be integrated with other business functions like marketing. We also showed you how to calculate CLV for your company.

Although, if you want to take it to the next level of simplicity, DiLytics can help you. With our decade-long expertise in data analytics, we have developed solutions to assist you in leveraging your data.

The data can help you calculate CLV and guide you in making better decisions on how to allocate your resources to retain customers. Contact us now and let’s talk about how we can assist you.