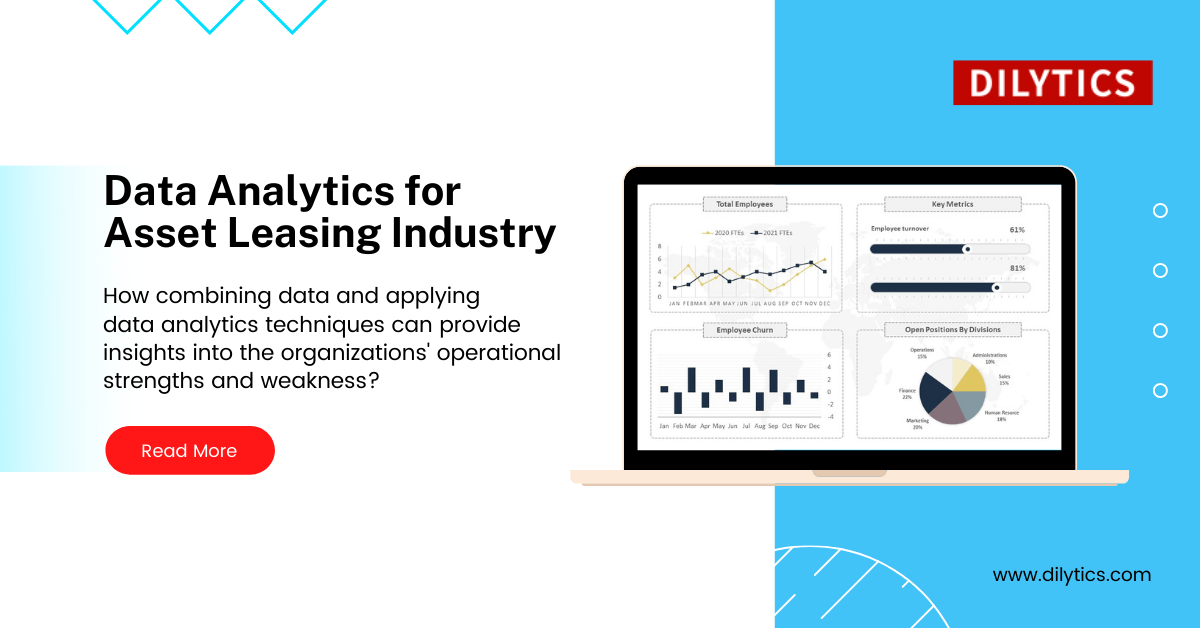

Businesses have evolved over the years and analytics has played a significant role in this evolution. From facilitating book-keeping to predicting trends to recommending solutions for business challenges, analytics has had a significant impact on businesses across industries during the past few decades. Asset Leasing has also been one such industry which has witnessed the beneficial impact of analytics during this time period.

Asset Leasing is nearly a trillion-dollar industry globally now. The assets leased include a wide range of items such as shipping containers, rental cars, agricultural equipment, construction tools, commercial vehicles, utility vehicles, IT equipment, electronic equipment, office equipment and storage spaces.

In this blog, we will focus on the significant role that we have experienced analytics play in the Asset Leasing industry.

Key Aspects of Asset Leasing Business

The key aspects of the Asset Leasing business are:

Type of Asset: Nearly all assets have models, versions and similar classifications based on the asset size, function and usage.

Type of Lease: This can be either:

- Contract Lease: Where assets are leased for a specified duration, post which, they are taken back by the leasing company. Businesses typically opt for contract leases for assets that are needed only for a short duration of time i.e., the duration is so short in comparison to the life of the asset that it makes no economic sense to buy the asset at the end of the lease period.

- Finance Lease: Where assets are leased for a specified duration, post which, the customer has the privilege to buy the asset at a fair price. Businesses typically opt for finance leases for expensive capital assets for which they find it difficult to make the capital investment themselves, upfront.

Role of Analytics in Asset Leasing Industry

Asset Leasing businesses, just as other businesses, need to track their financial health and performance. The use of analytics, therefore, lies in its ability to provide answers to a few questions that are pertinent to the Asset Leasing business, such as:

- Which customer segment is expected to yield more business?

- What assets added to the inventory would support business growth?

- Is it worth spending money on repairs/upkeep of an asset or a category of assets?

- Where is the scope to optimize operational costs such as the storage and transportation cost of an asset?

- Is it the right decision to hold on to an Asset?

Analytics in Sales Function

The sales executives are keen to obtain insights about customers and markets in their territory. With the right kind of insights, they will be in a much better position to formulate their pursuit plans. Some of the insights that sales executives will be interested in are:

Analytics in Operations Function

The Operations team holds a significant responsibility as they look after the assets inventory, transportation, general upkeep, repairs and disposal. Some of the insights that operations teams will be interested in are:

Analytics in Finance Function

The Finance executives need the reports to monitor the business’ financial health as well as validate business plans. Some of the insights that finance executives will be interested in are:

A Framework for Analytics in Asset Leasing Business

Like any other key IT initiative, an analytics program should ideally be kicked off by:

- Defining analytics strategy: that is in alignment with the overall business strategy and should take into consideration various challenges viz. data inconsistency and technical compatibility, that arise due to a multitude of transactional applications.

- Drawing a roadmap: that determines how the strategy should be implemented in terms of what are the various projects that should be undertaken within the larger program and in what logical sequence those projects should be implemented.

The above is typically done by conducting a quick ‘Analytics Strategy and Roadmap’ exercise. For more information about how this exercise can be undertaken, please have a look at our blog, Analytics Strategy and Roadmap – Compass and Clock for Analytics Leadership.

The key steps and elements in formulating analytics strategy are:

Goal Determination

- Identify and ring-fence the aspects of the Asset Leasing business for which analytics will be used.

- Determine if the scope of analytics covers only transactional data or also other data such as industry trends from external sources.

- List out functional areas where analytics will be utilized.

- Determine the nature of analytics to be performed – a defined set of reports generated at a defined frequency or flexibility for ad hoc analysis/reporting.

Data Strategy

- Based on the goal and end user’s requirements, determine what data is required.

- Formalize the nature of data to be considered i.e. structured or unstructured or both; historical or real-time or both; internal or external or both.

- Identify the systems from where the data will be sourced.

- Define the rules related to data access based on its sensitivity and the user’s role.

Data Modeling

- Define the structure and architecture of the data store which will house the data from various sources.

Data Integration

- Define the process (the method, mapping and frequency) for propagating the data from the source systems to the data store that will be used for further reporting purposes.

Data Visualization and Reporting

- Based on the end user’s requirements, define principles around data visualization such as guidelines where tables, numbers, charts and graphs will be used, where and how drill downs will be available.

Conclusion

In our experience, the Asset Leasing industry has been a victim of neglect, with many businesses failing to implement an effective process to leverage data analytics. It is not uncommon to find businesses store and use their data by more traditional means, such as in filing cabinets, dispersed within complex spreadsheets, or located in some shared drive. Due to this, they are unable to leverage the full potential of their data. Hence, it is imperative for businesses to implement analytics as it can provide significant insights that can help them optimize costs, improve profitability, formulate business strategies and manage risks.

To know more about influence of data analytics in asset leasing industry, contact us at [email protected].